Table of Content

The investor creates a straddle by purchasing each a $5 put choice and a $5 name option at a $100 strike price which expires on Jan. 30. The dealer would notice a profit if the value of the underlying safety was above $110 or below $90 at the time of expiration. If the price of the underlying will increase and is above the put's strike price at maturity, the choice expires nugatory and the trader loses the premium but nonetheless has the good factor about the elevated underlying value.

Full BioWith sensible experience running his personal IT business and an training within the liberal arts, Matthew Klammer had turn into well-accustomed to the difficulties of research. From providing POS methods to small vacationer retailers to knowledge security and account management Matthew has supplied business options to many people. Refunds will only be applied to the account charged and might be credited inside roughly 4 weeks of a legitimate request.

Online Commodity Buying And Selling

The more of them, the extra handy it goes to be to use the change. Also, the variety of withdrawal and deposit choices can point out the status of the corporate. As a rule, popular fee techniques do not work with exchangers which were found to have engaged in unlawful activities, or have confirmed complaints from prospects.

Intermediate and superior merchants will need a robust buying and selling platform and a full suite of options-specific buying and selling tools and sources. Along with these low commissions, tastyworks does not skimp on choices analytics, platform workflow, or trade enter. From there, it is straightforward to vary the expiration dates and strike costs for a chosen options technique. The platform also offers possibilities for the potential profitability of various options strategies. Now, for instance a name possibility on the stock with a strike price of $165 that expires about a month from now prices $5.50 per share or $550 per contract.

The Place Can I Follow Choices Trading?

For most brokerages, the minimum deposit required is lower than $1,000 for degree 1 options trading. Certain choices methods, corresponding to net-credit spreads, can require as much as $10,000 obtainable in your account and are thought-about level 2 or level 3. To apply for options buying and selling approval, buyers fill out a brief questionnaire within their brokerage account. While prices are one consideration when selecting an options broker and trading platform, there are other factors to weigh. If you're a new dealer, it is going to be helpful to have a broker that provides substantial educational offerings—such as articles, movies, and webinars.

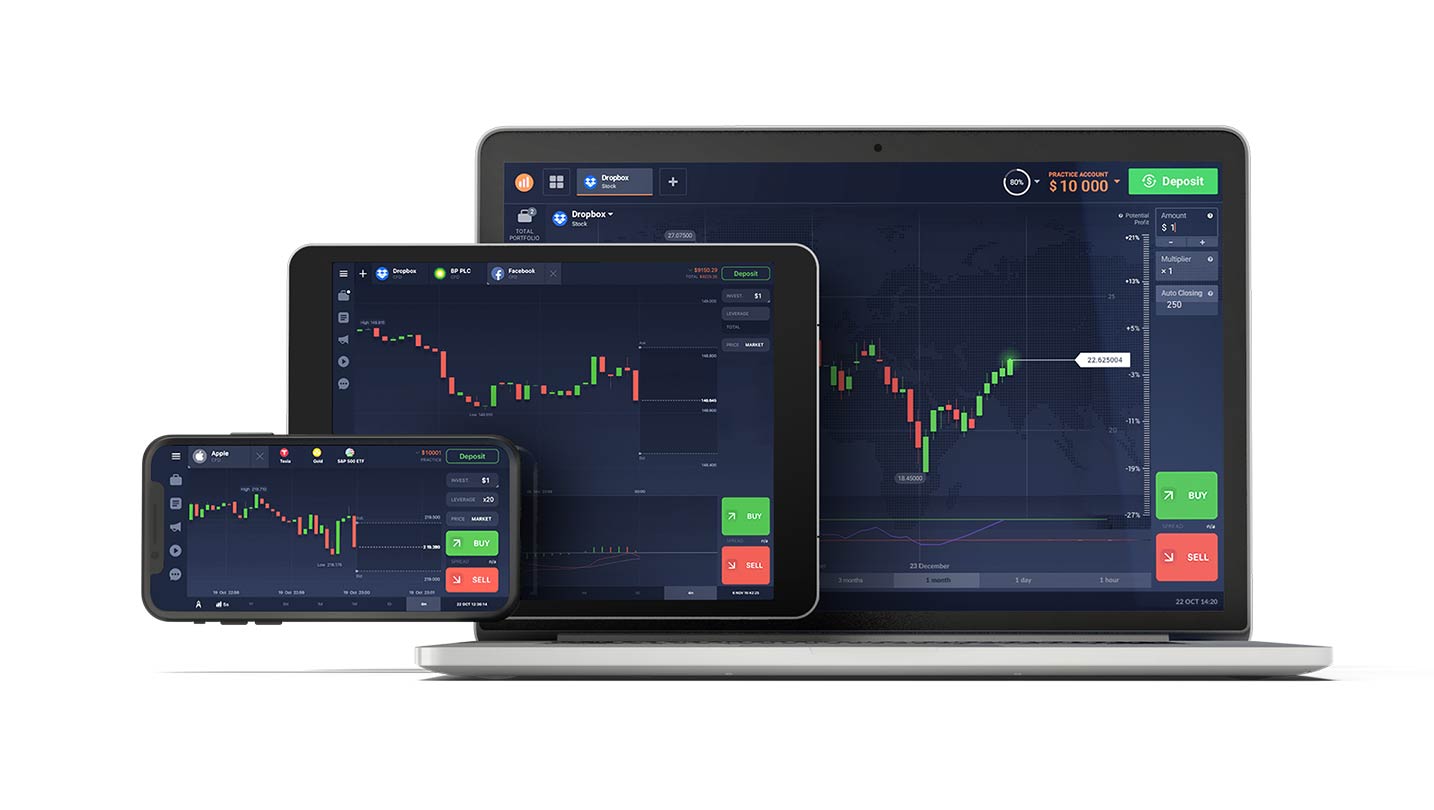

Of course, it is beneficial for the person to keep them as low as potential. When you purchase a stake in an S&P 500 ETF, you personal a portion of the fund that itself owns shares of all 500 corporations included in the index. This way, not solely do you diversify your portfolio significantly, but you additionally get the returns of the S&P 500. The trading room of the dealer you choose should have a graphical person interface that will allow you to navigate the charges and make the right bets.

Using options towards a present inventory or ETF holding is a typical options technique utilized by investors, and could be accomplished in two basic methods. The upside is the choice not being exercised, so the seller of the coated call keeps their stock and the premium they bought the coated name possibility for. Fortunately, Investopedia has created a listing of the most effective online brokers for choices buying and selling to make getting started simpler. If the worth of the underlying stays the identical or rises, the potential loss shall be limited to the option premium, which is paid as insurance.

You can learn how to use an choices buying and selling simulator and begin to know what methods will and gained't work persistently when buying and selling choices. You can examine buying and selling options, but it's different when trading in real-time. You can achieve valuable experience — particularly if you are a beginner investor — with an options trading simulator. Online choices trading courses may be as quick as a few hours to so lengthy as one yr.

Best Low-cost Option

But the fundamental calculation just isn't the one method to simplify buying and selling. Platform for online options trading should be useful, safe, and aware of any adjustments. The last two qualities of modern platforms are supported at about the identical degree, it's a matter of competitiveness.

However, this instance implies the dealer doesn't expect BP to move above $46 or considerably under $44 over the following month. As lengthy as the shares don't rise above $46 and get referred to as away earlier than the choices expire, the trader will maintain the premium free and clear and might proceed selling calls towards the shares if desired. Let's check out some primary strategies that a newbie investor can use with calls or puts to restrict their threat. The first two contain utilizing options to position a course guess with a restricted downside if the bet goes incorrect. The others involve hedging strategies laid on high of present positions. The easy truth that you could potentially earn cash out of exercising in addition to buying and promoting them additional serves for example simply how much flexibility and flexibility this form of buying and selling presents.

Benzinga's #1 Breakout Stock Each Month

Supporting documentation for any claims or statistical data is on the market upon request. An choices contract provides the holder the right—but not the obligation—to buy or sell the underlying asset at a set “strike” worth on or before a sure “expiration” date. A name option offers the owner the best to purchase a inventory at a set value and by a sure time, whereas a put option gives the proprietor the proper to sell a stock at a set price by a sure time.

Options trades shall be topic to the standard $0.sixty five per-contract fee. Service costs apply for trades positioned through a broker ($25) or by automated telephone ($5). See the Charles Schwab Pricing Guide for Individual Investors for full charge and commission schedules. The kind of options you are approved to commerce, and the broker’s policies will help determine the minimum funding quantity required for options trading. In common, $1,000 is the minimal required deposit for stage 1 (entry-level) options trading, however the minimum deposit may be a minimum of $10,000 for degree 2 or stage three choices trading. Even if the required minimal is low, it's at all times a good idea to have at least $5,000 to $10,000 to start buying and selling options.

No different costs or bills, and no market losses shall be refunded. Schwab reserves the right to alter or terminate the assure at any time. The interactive Trade & Probability Calculator helps you assess the potential threat, reward, and pricing eventualities of a trade before inserting it. Whether you are bullish, bearish, or neutral, Idea Hub™canvases the market for commerce ideas based mostly on market motion, volatility, earnings, and income-based methods. We believe everyone should be ready to make monetary choices with confidence. Our editors independently analysis and recommend the most effective services.

Furthermore, you'll be able to arrange a cutoff time or modify your positions by 4.15 PM. Rated because the #1 desktop program, thinkorswim helps investors test and develop your strategies as you execute trades, both easy and sophisticated. The real-world strategy to market developments makes this course appealing for these with some buying and selling background who don’t mind paying a premium worth. Our-step by-step method to the Market, evaluation routines, and trading templates, provide a clear path to higher trading. As a member, additionally, you will turn out to be part of a singular community of traders and college students.

No comments:

Post a Comment